Are online gambling winnings taxable? Yes, whether you gamble at land-based or online casinos, the money you earn is subject to federal income tax. Known as gambling income, the money you earn from wagers and bets as well as lotteries, sweepstakes, etc. all must be taxed.

In some cases, you will be provided with tax forms that must be turned in to the federal government. The full amount of the gambling income minus the cost of the winning bet will be included on this form. Whether you receive this form or not, it’s important to know your responsibilities when it comes to filing income taxes.

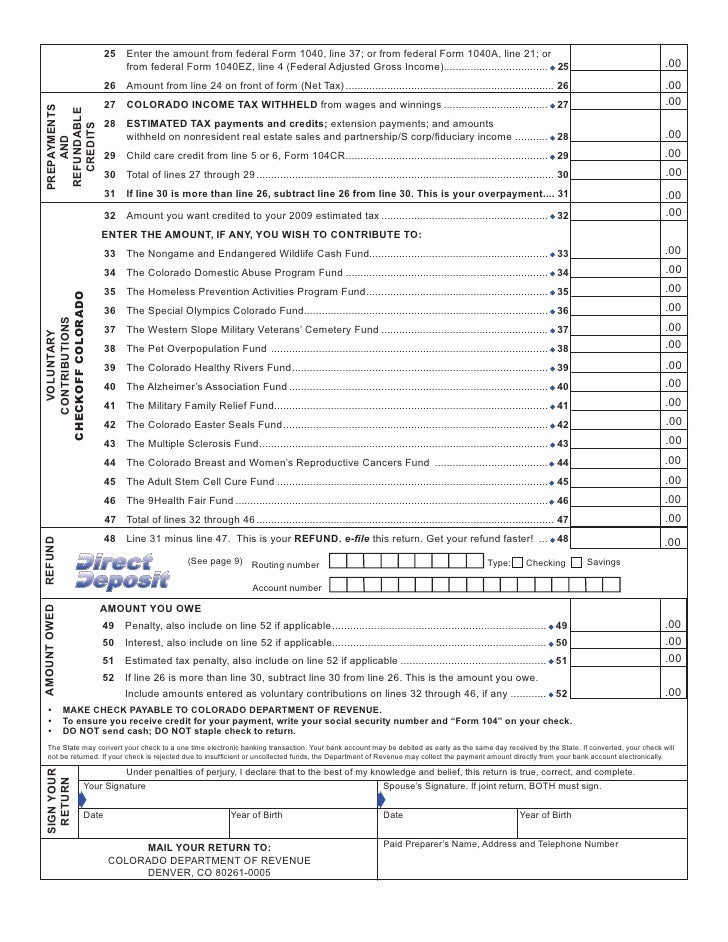

A non-professional gambler receives a W2G from the casino and the reported winnings will flow to Line 21 - Other Income on the Schedule 1 of the 1040. The amount of losses can be taken on the Schedule A Line 16. This deduction is limited to the amount of winnings. You may deduct gambling losses only if you itemize your deductions on Schedule A (Form 1040 or 1040-SR) PDF and kept a record of your winnings and losses. The amount of losses you deduct can't be more than the amount of gambling income you reported on your return. Claim your gambling losses up to the amount of winnings, as 'Other Itemized Deductions.' Gambling Winnings. Taxable 1040, line 21=winnings Receive W2-G 1040 line 62=tax withheld. Long-term Disability Income. Receive 1099-R Wages 1040 UNTILL retirement age.

The process of handling gambling taxes is not difficult if you know what to do. With this in mind, the OUSC team created this quicktax guide to help US players report their online gambling income.

You must include your gambling winnings in income on Form 1040, line 21. Publication 505 - Tax Withholding and Estimated Tax - Gambling Winnings. Gambling winnings are reported on Line 21 of Form 1040. Gambling losses not exceeding the amount of gains are deductible on Schedule A as a miscellaneous deduction. Compensatory damages for physical sickness are tax free whether fixed by court of in a negotiated settlement.

Gambling Winnings 1040 Line 21 Instructions

Do US Players Have To Pay Taxes For Online Gambling?

So, if you enjoy online gambling at sites like BetOnline or Bovada Casino, do you have to pay taxes? When you choose to gamble online, the money you earn is still taxable. Even if the site is located in another country, you still have to pay taxes.

Online gambling is unregulated in most regions of the US, but taxes must still be paid. Just because you do not receive tax forms, does not mean that your winnings are not taxed.

To the IRS, it does not matter where the money is either. If you have funds in your online casino account, even if it’s an offshore site, it’s taxable. When dealing with online gambling earnings, it’s important to review this information with an accountant to ensure you pay the right amount of taxes owed.

Below you will find a list of gambling activities that the International Revenue Service considers taxable:

- Prizes

- Private Party Games

- Tournaments

- Scratch Off Tickets

- Other

How Do You Report Gambling Winnings?

The way you report your gambling activities will be dependent on how you win. If you receive a Form W-2G, then this is what you will turn in when filing taxes. Taxes must be filed before April 15th or you must ask for an extension. You will turn this form in as you do your other tax forms for employment to an accountant or tax filing company.

If you do not receive the W-2G form, then you will need to fill out a Form 1040, adding the winnings to Line 21 of the form. The full amount of gambling winnings will be placed on this line.

When filling out the 1040, you will need to configure your losses as well. The expense you had for bets, wagers, etc. will need to be deducted as an itemized deduction. This is done on the “Other Miscellaneous Deductions” line of Schedule A form. This will help to lower the tax amount paid on your total gambling income.

What Types of Records Do You Need?

The information you record while enjoying online gambling can be used during the filing process. It’s important to maintain a log or diary of all your losses and winnings. Keep in mind the following information:

- Dates: You will need to record the date and type of activity completed, including wagers and winnings.

- Location: List the name and location of the gambling facility. In the case of online gambling, this would be the website, such as MyBookie or Café Casino.

- Checks: If you are sent any checks in the mail from winnings, be sure to keep the check stub.

- Paperwork: For some players, winnings will be sent via mail and any paperwork should be kept and used during filing as needed.

Don’t Forget To Pay Your Online Gambling Taxes

Gambling Winnings 1040 Line 21 Form

When you gamble online, it is important to enjoy yourself, but also remember to file your winnings! The IRS takes gambling money very seriously and you want to be sure that you pay your taxes accordingly. If you need any additional information, be sure to visit the official website of the IRS to find all the previously mentioned forms you will need fo file your taxes.